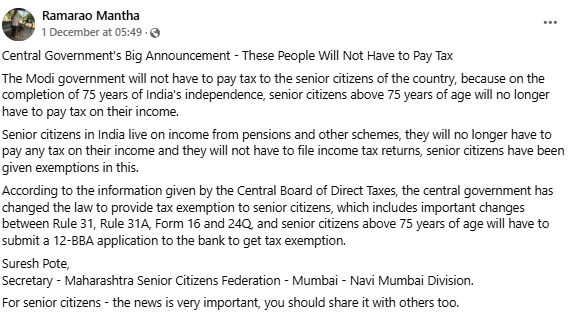

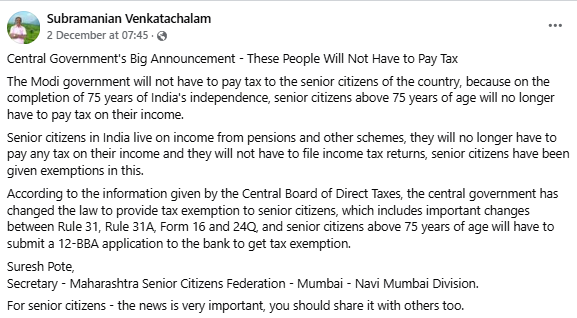

Several social media users claimed that the Modi government has exempted senior citizens, above 75 years of age, from paying Income Tax to commemorate 75 years of India’s independence.

The viral message detailing the alleged ‘Big announcement’ by the Centre, states, “The Modi government will not have to pay tax to the senior citizens of the country, because, on the completion of 75 years of India’s independence, senior citizens above 75 years of age will no longer have to pay tax on their income. Senior citizens in India live on income from pensions and other schemes, they will no longer have to pay any tax on their income and they will not have to file income tax returns, senior citizens have been given exemptions in this…”

Multiple Facebook users claimed that senior citizens above 75 will no longer have to pay Income Tax.

Fact Check/Verification

A keyword search for “Senior citizens,” “75 years” and “Income Tax relief” on Google did not yield any credible reports stating that such a decision has been taken place by the Modi government. However, we did come across multiple reports carrying a clarification on the viral claim by the Government’s PIB Fact Check.

In an X post, dated November 28, 2024, the PIB Fact Check stated that the viral message claiming “India commemorates 75 years of its Independence, senior citizens above 75 years of age will no longer have to pay taxes” is “fake.”

“Senior citizens above 75 years, with only pension and interest income, are exempt from filing ITR (as per Section 194P). Taxes, if applicable, are deducted by the specified bank after computing the income and eligible deductions,” it further clarified.

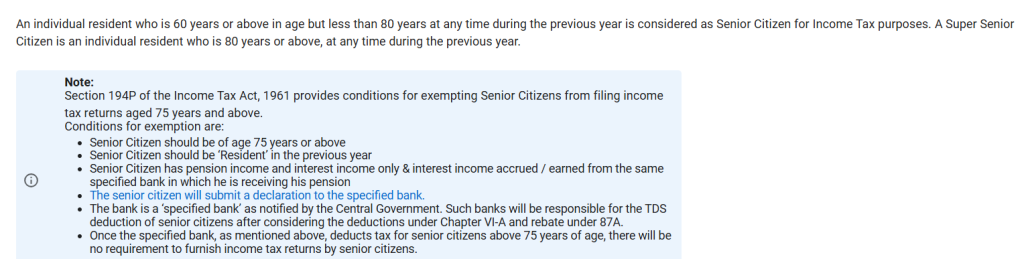

We then skimmed through the ‘Returns and Forms Applicable for Senior Citizens and Super Senior Citizens for AY 2024-2025’ section on the Income Tax Department’s website. It detailed that Section 194P of the Income Tax Act, 1961 provides conditions for exempting Senior Citizens from filing income tax returns aged 75 years and above.

Such conditions are listed below:

- Senior Citizens should be of age 75 years or above

- Senior Citizens should be ‘Resident’ in the previous year

- Senior Citizen has pension income and interest income only & interest income accrued/earned from the same specified bank in which he is receiving his pension

- The senior citizen will submit a declaration to the specified bank.

- The bank is a ‘specified bank’ as notified by the Central Government. Such banks will be responsible for the TDS deduction of senior citizens after considering the deductions under Chapter VI-A and rebate under 87A.

- Once the specified bank, as mentioned above, deducts tax for senior citizens above 75 years of age, there will be no requirement to furnish income tax returns by senior citizens.

Notably, Section 194P has been in effect from April 1, 2021.

For the Assessment Year 2024-25, income up to Rs 3,00,000 remains untaxable for senior citizens in the age bracket 60-80 years (60 years or more but less than 80 years of age).

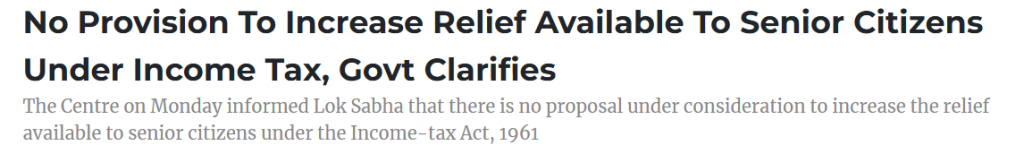

No Provision To Raise Income Tax Relief Available To Senior Citizens: MoS Finance

The government recently informed the Lok Sabha that there was no proposal under consideration to increase the available relief to senior citizens under the Income Tax Act, of 1961.

The Minister of State for Finance, Pankaj Chaudhary reportedly said that a few proposals are made yearly during the budgetary exercise to make amendments to the Income Tax Act, of 1961. However, “no such proposal is under consideration,” regarding increasing the available relief for senior citizens, reported Outlook.

Hence, the viral claim that the center has exempted senior citizens above 75 years from paying Income Tax was found to be false.